-

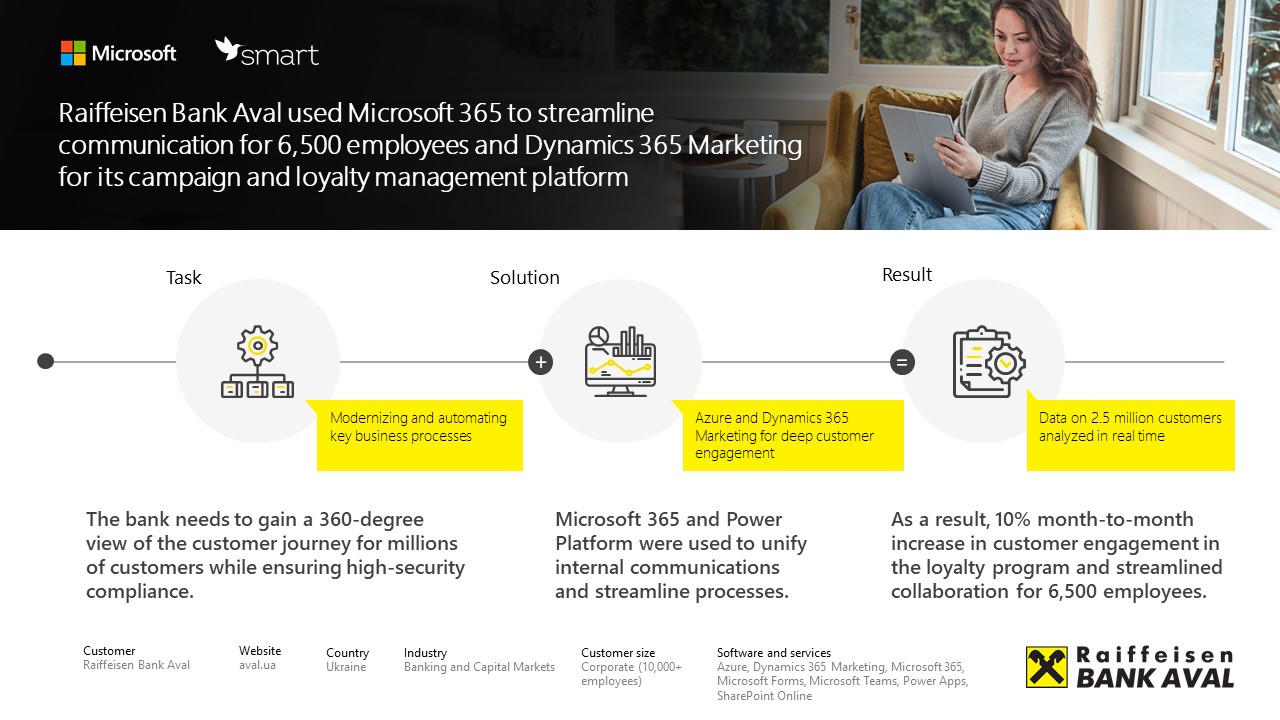

Ukraine’s Raiffeisen Bank Aval reshapes 2.5 million customers’ experience with Microsoft cloud solutions

Beginning in October 2005, Raiffeisen Bank Aval (RBA) offers a wide range of standard and up-to-date banking services used by more than 2.5 million customers.

Recognized as “Best Bank in Central and Eastern Europe” by The Banker for the fifth time in a row, RBA always strives to exceed customer expectations and improve customer service and personal engagement. To empower its 6,500 employees spread across the country, RBA used Microsoft 365 to streamline communication and processes. Then, to deliver a connected multichannel experience for all its clients, the bank used Azure and Dynamics 365 Marketing for its campaign and loyalty management platform.

-

Customer

Raiffeisen Bank Aval

Website: aval.ua

Country: Ukraine

Industry: Banking and Capital Markets

Customer size: Corporate (10,000+ employees)

Customer profile

Ukraine’s third-largest bank, Raiffeisen Bank Aval (RBA), has more than 6,500 employees across 400 branches. It was recognized as “Best Bank in Central and Eastern Europe” by The Banker for the fifth time in a row.

Software and services

Azure

Dynamics 365 Marketing

Microsoft 365

Microsoft Forms

Microsoft Teams

Power Apps

SharePoint Online

-

Ukraine’s third-largest bank, Raiffeisen Bank Aval (RBA), has more than 6,500 employees across 400 branches. With such a scale, it needed a centralized environment for enhanced internal communication and processes. “Raiffeisen Group has strict regulations for working in the cloud, and enabling granular access control, security analytics, and compliance features such as procedures for transaction authorization was a must for us,” explains Petro Voronov, Head of IT Support Department at RBA.

“We decided to roll out Microsoft 365 back in 2016 because Microsoft solutions’ security features are of the highest level.”

Petro Voronov,Head of IT Support Department

Petro Voronov,Head of IT Support DepartmentEffective processes, smooth information flow

Until 2020 RBA has unified all communications and file management with Microsoft Teams and SharePoint Online. Through automation, collaboration is now easier — and more efficient than ever. “We use [Microsoft] Power Apps for process automation such as internal document approvals, and create tasks using Microsoft Forms, integrated within Teams,” says Oleksii Rybalchenko, Head of IT Governance & Finance Department at RBA.

“Now our HR team can arrange and conduct remote interviews using these tools.”

Oleksii Rybalchenko,Head of IT Governance & Finance Department

Oleksii Rybalchenko,Head of IT Governance & Finance DepartmentA connected journey for millions of customers

The bank also looked into enhancing the whole customer experience journey and strengthening customer relationships. In the past, the bank lacked a full view of each customer’s interactions, which affected the customer experience. To solve this issue, RBA joined forces with Microsoft technology partner SMART business and used the power of Azure and Dynamics 365 Marketing.

Data on the bank’s 2.5 million customers, both active and inactive, are analyzed in real time by the Azure-based loyalty module. It then defines what to propose to whom and when. And Dynamics 365 works with and manages all communication channels — from emails, to the bank’s mobile app, to the messaging app Viber.

“This integrated approach gives us both a 360-degree view of each customer and helps us personalize and orchestrate our marketing activities at scale. As a result, the number of customers that agreed to receive marketing communications has increased by 15 percent. And we’ve seen a 10 percent month-to-month growth in loyalty program involvement without any additional advertising.”

Tetiana Savelko,Head of Customer Relationship Management

Tetiana Savelko,Head of Customer Relationship ManagementAccording to Natalya Onyshchuk, Managing Partner at SMART business, “A solution with such intricate and comprehensive integrations is quite unique in the banking sector. And all this was done while complying with all the bank’s security and legal requirements and ensuring a quick and smooth transition for the users,” she says.

The bank is developing the loyalty platform to also engage external partners into the ecosystem. For now, Raiffeisen Bank International is also assessing the Azure-based loyalty module for deployment in other countries of presence.

To view the history on the Microsoft Customer Stories resource, follow the link.

To learn more about the solutions and services of SMART business, call +38 (044) 585-35-50 or submit your request here.

-

Learn more about